Tesla billionaire Elon Musk is now a political heavyweight and key Donald Trump ally and is exercising significant influence over government through his use of the X platform and the America Political Action Committee, which financially supported Republican campaigns in the 2024 election.

Elon Musk’s support for Donald Trump’s victory doesn’t come without personal favors. Namely, Musk is expected to co-staff a new department with his fellow tech billionaire, Vivek Ramaswamy, called “The Department of Government Efficiency” or “DOGE.”

Musk affirms that the DOGE will help cut wasteful spending by upwards of two trillion dollars while increasing the productivity of government agencies by establishing productivity goals and firing 75% of federal employees, which he believes are too procedural, inefficient, and bloated.

Furthermore, the department’s co-head Vivek Ramaswamy argued on the Lex Fridman Podcast that 5% of Federal government employees do all the work, and the rest do nothing, meaning removing government agencies and firing more than half of the government’s workforce will do little harm and benefit the American taxpayer.

Others argue that a plan to remove important agencies such as the Department of Education, the Federal Bureau of Investigation, and the Nuclear Regulatory Agency would have dangerous consequences: lack of proper education, an inability to enforce federal law, and a greater risk of nuclear contamination. They also argue that firing 75% of government employees will cause institutions to fail.

For instance, they argue that firing almost every investigator in the Internal Revenue Service and Federal Trade Commission would make it much harder to enforce tax codes and protect taxpayers from fraud.

However, the presidency and executive agencies don’t have carte-blanche to spend or cut as they wish because Article I Section II of the U.S. Constitution delegates that power to Congress, not the president.

Nevertheless, even without the power of the purse, the DOGE would provide recommendations for Congress and audit certain agencies to ensure fiscal competence.

Such an agency likely could have been made after WWI, given the increasing scope and size of government, as well as the rent-seeking and nepotism that was occurring in the federal government.

Instead, they passed the General Accounting Act of 1921 on June 10. The bill established the framework we now use to propose budgets in government. It mandated that the president propose an annual federal budget to Congress to pass, centralizing the government budget process, and enabling the president, Congress, and agencies to work together more cohesively.

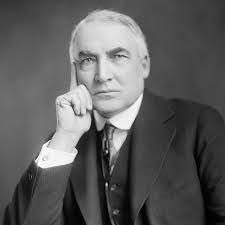

This was necessary as the government grew because beforehand, each agency would individually draft and propose budgets for Congress to pass and the president to sign. Therefore, passing budgets was inefficient, causing Americans to demand a more structured process. In response, Congress and President Warren Harding passed a bill to create a more efficient and accountable process.

After the bill passed, the process became streamlined, enabling the president to propose a full-fledged budget to Congress for all agencies.

Additionally, to ensure the budgets were created efficiently and centralized with little overlap, the Office of Management and Budget (OMB) and the Government Accountability Office (GAO) were established.

The OMB reviews all funding requests from government agencies to deal with any overlapping inconsistencies; after the OMB clears the budget, the president proposes the budget to Congress.

On the other hand, the GAO audits and investigates all federal agencies, ensures they are handling resources efficiently, and advises Congress on where to cut and increase spending.

The active GAO and OMB currently resemble the proposed Department of Government Efficiency.

Although the DOGE may sound like a recycled version of existing departments, there are still notable differences. The OMB and the GAO are established government agencies that have broad oversight powers, whereas the DOGE has no formal authority and serves as an advisory group. Hence, the new “department” will likely have negligible results in the coming years, as most fiscal decision-making will lie with Congress and the established departments.