College can be overwhelming, with pressures from classes, sports, career building, and everything else in between. Adding personal finance or investing into the mix might feel like just another source of stress — or maybe it’s something you haven’t even thought about yet. But the truth is, just like any new challenge, managing your finances doesn’t need to be tackled all at once.

It’s a gradual process, and you can start taking small, manageable steps. In this article, we’ll guide you through the first steps in managing your money and making it work for you.

Before diving in, it’s important to assess your current financial health. Once you understand where you stand, you’ll be able to determine your time horizon and risk tolerance, setting a solid foundation for the steps ahead.

If you are an average college student, there is a decent chance you carry some form of student debt and maybe have a credit card or two. No shame, but it’s important to keep in mind the debts you currently hold for student loan payments, credit card payments, and any other debts because this will affect how much extra money you have to invest.

Additionally, you should identify the different ways in which you earn money through jobs, side gigs, creating content or products, or even owning a business. Ideally, before you start investing, you should have some money leftover after simply subtracting your general income from your financial obligations, such as taxes, bills, food, etc. This amount can be as little as a single dollar.

Now that you have your current pool of money, you need to determine your investment goals, the rough timeline you have to achieve your goals, and your risk tolerance during this process.

In the world of finance and investing, we call that timeline towards a financial goal a time horizon. For example, if you have the goal of trying to pay off your student loans, you will have a shorter time horizon than if you were simply saving money for retirement. A short time horizon means that you shouldn’t invest in high-risk investments like stocks where there is a chance of losing all of your money.

Instead, you should look at safer options like bonds that carry little risk.

With more risk, there is more chance of a high return on your investment, but there is also a higher chance your investment will lose you money. If you find yourself in the middle between a low and high risk tolerance and have a somewhat long time horizon, you should consider investing in an exchange-traded fund (ETF) or an index fund that holds a mix of both investments.

Diversification is an important strategy to consider when you are investing in different investments or securities. The terms investments and securities are used interchangeably in finance, and a collection of investments is called a portfolio. ETFs and index funds are securities that can provide instant diversification by containing a mixture of different types of investments in their portfolio.

Even if you hold securities made of just stocks or bonds, you can diversify your portfolio by buying stocks from different companies, sectors, or even markets. With bonds, you can buy them from the federal, state, and municipal level. Companies like Coca Cola and even Moravian University sell bonds that you can purchase right now.

U.S. Treasury bonds are considered the most tolerant to risk, and a bond from Coca Cola is less tolerant comparatively. By buying both you get a greater amount of diversification, lower chance of losing all your money when you start investing, and get more potential profit in the long run.

Regardless of the type of investments you choose or the level of diversification you have, it is in your best interest to start investing now is because of the effect of compounding interest. To explain this simply, imagine you invested $100 into a savings account with 10% annual interest.

After one year you would earn $10 from interest and your total amount would be $110. Going forward, your interest would be calculated on the money you have from previous years and not just the amount you first invested with. After two years, your balance with the same 10% interest would be $121.

The only thing you did was make that initial investment and let it sit in the savings account.

You made $21, and this is a simple, isolated example. In the real world, the interest of 10% will most likely be a different percentage and the interest payments could occur more frequently than a year. The longer you leave your money invested, the more it can grow.

The world of finance and investing is filled with more than just stocks and bonds. There are other investments such as retirement accounts, real estate, cryptocurrency, like the infamous bitcoin, and much more. However, as first steps go, buying a simple stock or bond is a good place to start.

Identifying your financial health, time horizon, and risk tolerance first will help with your investments and gaining financial freedom going forward, wherever you find yourself. This Chinese proverb puts it best: “The best time to plant a tree was 20 years ago, but the second best time to plant a tree right now.” Happy investing!

Investment Club Corner: Events, News, & Everything You Need to Know

Events

- Please join the Amrhein Investment Club at 7 p.m. in Sally 121 on Wednesday nights to learn more about investment strategy, market trends, and to be a part of a 6 million dollar investment portfolio!

- Amrhein Investment Club will be returning to the Quinnipiac GAME Forum to defend its win in the Undergraduate Core Portfolio category which recognizes the best-balanced, diversified, and researched student portfolio. ] This event will be held on Apr. 3 and 4 this year at the New York Marriott Marquis in New York City.

- Amrhein Investment Club has been invited back to SEI for their Future Leaders in Finance Day on Apr. 11, 2025, in Oaks, PA from 12:30 p.m. to 3 p.m.

- The Institute of Management Accountants (IMA) will be holding a conference on Apr. 11, 2025, at DeSales University from 8 a.m. to 12 p.m. Moravian is looking for seven students to prepare a presentation on various information systems used in managerial accounting.

News and Holdings

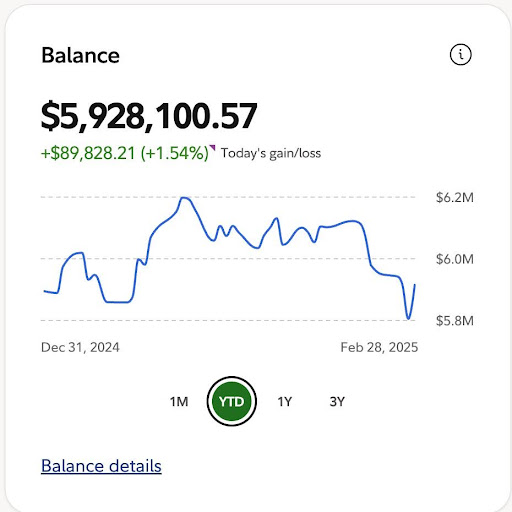

Despite market volatility with the onboarding of a new presidential administration, Amrhein Investment Club’s portfolio has still persevered to maintain a growth of 1.4% across the entire portfolio as of the market close on Feb. 21, 2025. Market volatility is common with new presidential administrations due to uncertainty regarding the future regulation of financial markets. Investors are weary of what to invest in, which creates irregular fluctuations in the market and causes stocks to rise and fall rapidly. Feb. 21, 2025, has been regarded as the worst day in the stock market of 2025, with the S&P 500 dropping over 100 points, the Dow Jones Industrial Average falling 700 points, and the Nasdaq Composite Index falling over 400 points. This volatility is attributed to higher-than-expected inflation rates, impending tariffs, and financial releases below expectations for S&P 500 stocks like Walmart. Currently, the Amrhein Investment Club portfolio resembles an aggressive growth strategy with over 91% of our holdings being in domestic stocks. Amrhein’s fund managers will continue to work to combat market volatility by choosing when to buy and sell new stocks to strengthen their funds as they prepare to attend the Quinnipiac GAME Forum.