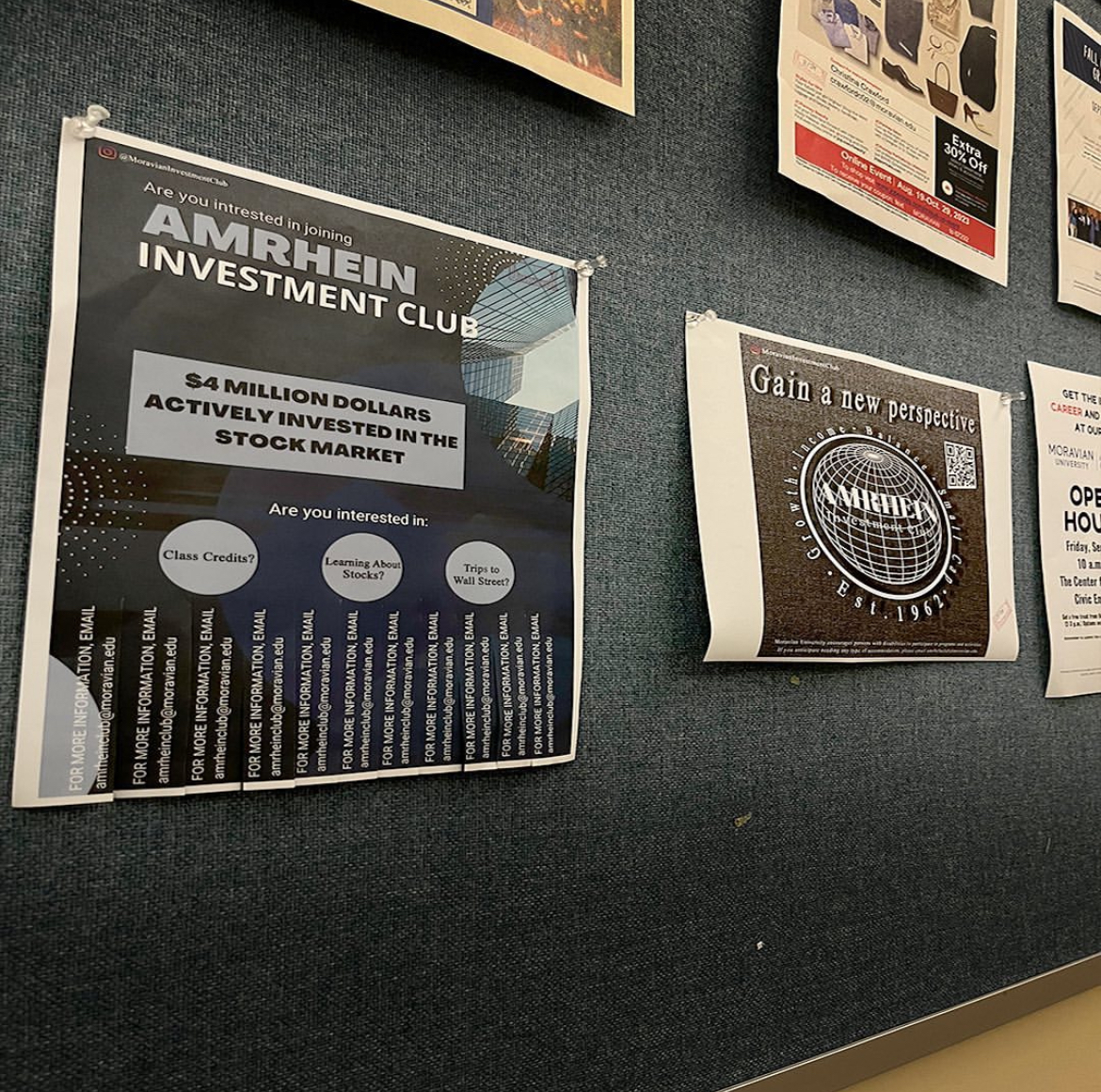

As a first-year student at Moravian, I found that one of the things that drew many students to the University was the plethora of opportunities for personal and hands-on experience in almost every field you desire. Perhaps not so much when it comes to business and economics, but by no means is hope lost while the incredibly impressive Amrhein Investment Club is still running.

The club was founded in 1972, when $20,000 was donated by generous Moravian alumni, Irving S. and his wife Alma Clauser Amrhein, to kick-start it. The fund has grown impressively, sitting at $4.5 million as of this year. The progress of growth only continues, especially with the help of President Emma Garchinsky ‘25.

Emma is majoring in Organizational Leadership and a participant in the 4+1 Masters of Business Administration program. She also has extensive experience in the field of investment, having worked as an assistant to a financial planner.

Weekly meetings, usually held at 7 p.m. on Tuesdays, are held to discuss the progress of the total fund and major news going on in the investment world outside of Moravian. The fund is broken down into four main categories: Income Fund, Small Cap Fund, Growth Fund, and Future Fund, all of which have different areas of investment.

The Growth Fund invests in stocks with higher potential for sales and earnings growth. The Balance Fund focuses on mid to large capital high-quality common stocks to achieve above-average capital appreciation over a period of three to five years. The Income Fund invests in capital to ensure stability within the fund. The Small Cap Fund opts for diverse smaller stocks, which carry higher risks.

These funds together create The Investment Club. The money earned is mainly reinvested into the funds themselves and each is led by a fellow club member who oversees progress and determines appropriate times to hold buy or sell presentations for it. Decisions are made together as fund members on what would be the most beneficial for their growth. The club constitution is relied on in order to guide how to go about these presentations and how voting for certain actions will be conducted.

The club comes together at its weekly meetings to review the progress of the overall fund and each category. Not only do members get insight into the fund itself, but they also get insights into world events and business decisions that have an impact on the market.

During week four of the club’s meetings, occurrences such as workers’ strikes, rising oil prices, and potential government shutdown were discussed to help understand the current climate of the market. There are also fun mini-lessons brought to every club meeting, which cover specific concepts pertaining to investing, such as what dividends are and what debt to equity ratio is.

Meeting are also set up so those who are not as familiar with investing can learn along the way and be included as well. Members also get the benefit of being eligible to earn class credit for maintaining at least 70% of attendance at club and fund meetings.

It is a unique experience, getting to see firsthand the development of a legitimate investment as such. With that being said, it wasn’t always smooth sailing for the club. Major world events such as the COVID-19 pandemic and the Ukrainian war have sent shocks that were felt in every aspect of life, of course, the funds being no exception whatsoever, with losses as big as $700,00.

However, these hurdles were nothing that couldn’t be overcome, especially with skilled students to support it. Garchinsky led the buy which brought in the highest return in a short period of time while she was only a sophomore. Being the manager of the Small Cap fFnd at the time, she took her time to look into what would benefit the fund the most before going on with the purchase of the stock PERI.

She describes the process of it as making an educated guess and “getting lucky” with the drastic improvements it brought in. Emma originally joined the club not having much prior knowledge of stocks or investing at all. These are the types of opportunities in which members of the club get to be involved and learn from.

The Amrhein Investment Club currently serves as one of the main extracurricular activities for students to get involved in economics at Moravian.

Talks of reviving the Accounting and Business Leaders Club have come up, but no plans have been confirmed. Though the club has done an excellent job of keeping the interest of the University’s funds (plus the high value of the funds themselves) prosperous. The club has received progress in its attendance record since the start of this semester and has no intentions of slowing down.

Students interested may direct message via Instagram @moravianinvestmentclub or email [email protected] for more information on how to join.