On June 9, 2024, as election season began, former President Donald Trump said in a Nevada rally, “We are going to let you keep 100% of your tip income and not be harassed.” Roughly two weeks later, Trump made a viral Tiktok coining the slogan “No Tax on Tips.”

As of Oct. 17, his ‘Tiptok‘ has been viewed 86.8 million times and has 8.3 million likes.

In response, Vice President and current Democratic presidential candidate Kamala Harris clapped back at an August 10 rally in Las Vegas when she promised Nevadans, “We will continue our fight for working families of America, including raising the minimum wage and eliminating taxes on tips for service and hospitality workers.”

On Sept. 9, Harris published her economic plan after meeting with several business and union leaders. The plan proposed eliminating the sub-minimum hourly wage of $3 an hour for tipped workers and applying the standard federal minimum hourly wage of $7.25 to all tipped jobs.

In an election with razor-thin margins where credible polls are all within the margin of error, the service workers in the swing state of Nevada that the vice president and former president are reaching out to could be decisive.

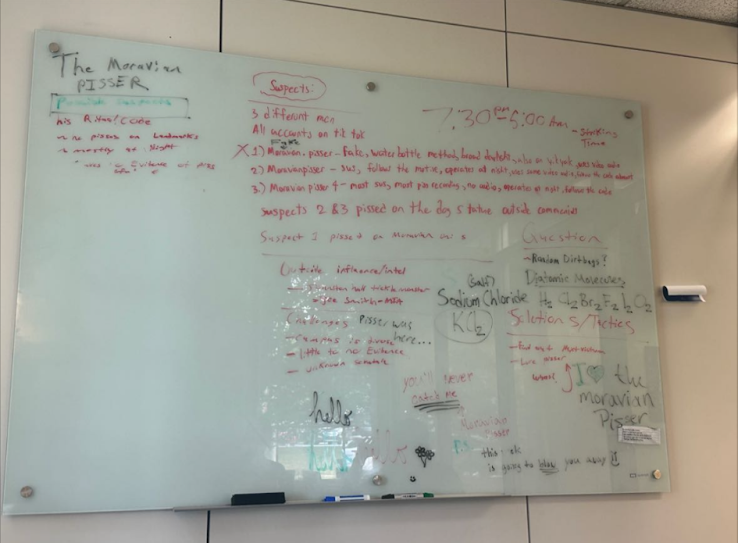

However, if the national government passed a “No Tax on Tips” bill, it would apply to not only Nevadans but to all four million American tipped workers, including Moravian students who receive tips.

Environmental science major Caleb Gunkle ‘24, a waiter at Hotel Bethlehem who relies on tips for his income, is one of them.

“When I am serving, tips are almost all the money you make, usually $3 an hour, and tips are the rest of it,” said Gunkle. “It is your whole income.”

In response to the No Tax on Tips policy, Gunkle said, “I would enjoy that as a service worker. I don’t know how it would impact the broader economy, but I think it is a good idea.”

Despite expressing optimism for a tax break, Gunkle suggested that increasing the minimum wage for tipped employees would help him out more.”Your income would be taxed,” he said. “But you would get stability.”

On the other hand, communications major Caillie Fish ‘24, a waitress at Galera Dos in Dunsville, Pennsylvania, expressed a mix of satisfaction and frustration with tipping wages.

“They are supposed to be a form of gratitude, but now I need it,” she said.

Fish agreed that not taking tips would be helpful. “It sucks that we are taxed on tips, because we don’t make minimum wage without them.”

Fish also said that matching the minimum wage for tipped workers with the minimum non-tipped salaries would be even more beneficial. “We should get minimum wage, and it should be raised. People don’t tip much already.”

However, economists in general question the benefit of a No Tax on Tips policy, seeing it as a problematic policy that distracts from broader issues while creating negative externalities.

A report by the Yale Budget Lab, for one, explains that tipped workers only make up 4% of workers who earn below $25 an hour, and 37% already make too little to be taxed. Thus, the political hype around how No Tax on Tips will drastically improve the lives of struggling working-class Americans is just that: hype. Any effect, if the policy even has one, will be trivial.

The report also states that the policy could implicitly encourage tax avoidance, as some workers, employers, and customers could collaborate to classify other transactions as tips to evade taxes. For instance, firms could reclassify commissions as tips, just as some business owners currently falsely classify wages as profits in order to evade paying the payroll tax.

Finally, the report warns that as tipping becomes more popular, businesses will exploit tipping to offset the cost of labor to consumers while lowering wages. These projected behavioral outcomes could explain why interest groups like the National Restaurant Association have advocated for the policy while opposing Harris’s linked proposal to eliminate the sub-minimum wage.

While “No Tax on Tips” has been a contested policy that both presidential campaigns have bickered over, it has sparked intense debate and speculation that won’t be settled until a majority in Congress passes a “No Tax on Tips” bill. So, while a ‘Tiptok’ may help decide the 2024 presidential election, its proposal isn’t even in the hands of the presidency. So make sure to keep that in mind before tossing those pivotal down-ballot races.